In GLO-BUS, 1 to 5 class members are assigned to run a digital camera company that produces and markets entry-level and upscale, multi-featured cameras in head-to-head competition against camera companies run by other members of the class. As many as 12 companies can compete in a single industry grouping (class sizes above 50 are typically divided into two or more industry groups). The companies compete in a global market arena, selling to camera retailers in four geographic regions—Europe-Africa, North America, Asia-Pacific, and Latin America.

The co-managers of each company are responsible for assessing market conditions, determining how to respond to the actions of competitors, forging a long-term direction and strategy for their company, and making decisions relating to:

- R&D, camera components, and camera performance (up to 10 decisions)

- Assembly operations and worker compensation (up to 15 decisions for a single assembly plant)

- Pricing and marketing (up to 15 decisions in each geographic region)

- Corporate social responsibility and citizenship (as many as 6 decisions)

- Financing of company operations (as many as 4 decisions).

Each time co-managers make a decision entry, an assortment of on-screen calculations instantly shows the projected effects on unit sales, revenues, market shares, total profit, earnings per share, ROE, unit camera costs, and other pertinent operating outcomes, enabling co-managers to evaluate the relative merits of one decision entry versus another. Company managers can experiment with many different decision combinations in arriving at a decision combination and set of actions that seem likely to yield good company performance. In addition, there are 2-4 minute video tutorials for each decision screen and comprehensive Help sections that explain cause-effect relationships, provide tips and suggestions, explain how the numbers in the company and industry reports are calculated, and otherwise inform company co-managers how things work.

Each company typically seeks to enhance its performance and build competitive advantage via its own custom-tailored competitive strategy based on more attractive pricing, greater advertising, a wider selection of camera models, more appealing camera performance/quality, longer warranties, the amount/caliber of technical support provided to camera buyers, more aggressive sales promotion campaigns, and/or creating a stronger brand name reputation than rivals.

Any and all competitive strategy options—low-cost leadership, differentiation, best-cost provider, focused low-cost, and focused differentiation—are viable paths for a company to take. A company can have a strategy aimed at being the clear market leader in either entry-level cameras or multi-featured cameras or both. It can focus on one or two geographic regions or strive for geographic balance. It can pursue essentially the same strategy worldwide or craft slightly or very different strategies for each of the four geographic regions.

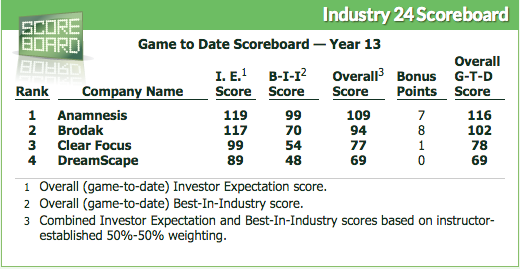

Each company's performance is based on a balanced scorecard that includes brand image, earnings per share, return on equity investment, stock price appreciation, and credit rating.

You have the option to schedule 1 or 2 practice rounds (2 is recommended) and anywhere from 4 to 10 regular/scored decision rounds (6 to 10 rounds are better than 3-5 rounds). Each decision round represents a year of company operations and takes roughly two hours for company co-managers to complete. Decision rounds can be scheduled weekly, bi-weekly, or at whatever intervals instructors wish. Sample schedules for courses of varying length and numbers of class meetings are provided.

When the instructor-specified deadline for a decision round arrives, the GLO-BUS server automatically accesses the saved decision entries of each company, determines the competitiveness and buyer appeal of each company's camera offerings relative to rival companies, and then allocates sales and market shares to the competing companies, geographic region by geographic region, based on:

- how each company's wholesale selling prices for its entry-level and multi-featured cameras compare against the corresponding industry-wide average prices being charged in each geographic region,

- how each company's camera performance and quality compares against that of rival brands

- how each company's advertising effort compares to rivals' advertising, and so on for each of the 11 competitive factors that determine unit camera sales and market shares.

There's no built-in bias favoring any one strategy and no "secret set of strategic moves" that are sure to result in a company becoming the industry leader. GLO-BUS is a "competition-based" strategy simulation exercise where the outcomes are always unique to the competitive interplay among the specific decisions and strategies of each group of competing companies. Which strategies end up delivering the best performance in any given group of 4 to 12 companies that are competing head-to-head always depends on the competitive interplay among the specific decisions and strategies of rival companies—there absolutely is no "magic bullet" strategy and no prescribed set of actions that will guarantee good company performance.

Company co-managers can access the results of the decision round 15-20 minutes after the decision deadline. Rankings of company performance, along with a wealth of industry and company statistics, are available to company co-managers after each decision round to use in making strategy adjustments and decisions for the next competitive round.

All GLO-BUS activities for class members and instructors take place here at www.flash.glo-bus.com.